tax loss harvesting canada

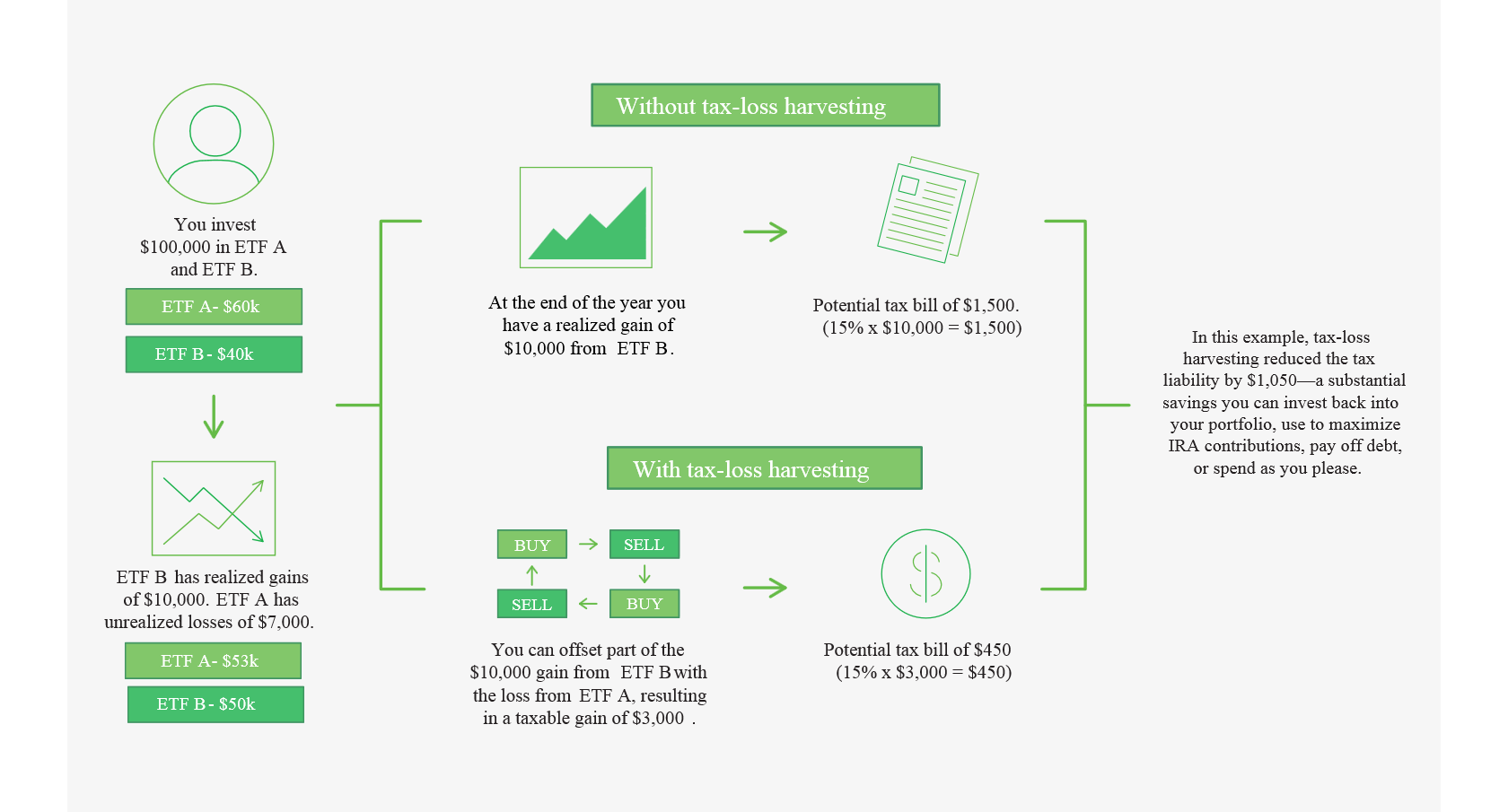

Tax loss harvesting is strategically selling at a loss and moving the money to a different enough investment so that its not a wash sale to reduce other capital gains. It is typically used to limit the recognition of short-term capital gains.

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

You can then use these losses to.

. Tax-loss harvesting occurs when you sell an investment that has dropped below its original purchase price triggering a capital loss. One consideration for investors when employing tax-loss harvesting is the superficial loss rule. If you exit both your 10k.

By selling your shares you. You need to move your money to different. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

This rule states that if an investor buys back the same security within 30 days of sale the tax. Reduce taxes in non-registered investment accounts. Find stocks that move together with or against ISHARESUse tax-loss harvesting and direct indexing strategies to offset the sell of ISHARES MSCI.

Thanks to the wash sale rule you cant just sell and repurchase the same investments. Pair correlation details including. Nevertheless its simple and straightforward if you understand a few guidelines.

Tax loss harvesting is a new term that might sound strange to ordinary people in Canada. The funds are then used to purchase a comparable. Its a strategy that applies only to taxable investment.

It offers a tremendous amount of. A capital loss can be used to offset a capital gain within a non-registered account. Minimizes the negative impact of losses inside your.

However in general you can expect to save around 30 of the amount of. Tax-loss selling also known as tax-loss harvesting is a strategy used to reduce taxes on capital gains incurred from the sale of an asset. Last Updated July 20 2022 544 pm EDT.

Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital. Tax-loss selling also known as tax-loss harvesting is a strategy available to investors who have investments that are trading below their original cost in non-registered. Tax loss harvesting consists of three steps.

Why tax-loss harvesting is different this year This is the first year in a long time where fixed income assets are delivering negative returns. On the contrary it is best thought of as a. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability.

The amount of money that you can save with tax loss harvesting in Canada depends on your tax bracket. Tax-Loss Selling Made Crystal Clear. Tax loss harvesting is a method of reducing your taxes on capital gains realized from the sale of certain investments.

First you need to estimate your current capital gains for the year and. To help heres a bullet point list of tax-loss selling advantages. How to tax loss harvest.

Tax-loss selling or tax-loss harvesting occurs when you deliberately sell a security at a loss in order to offset capital gains in Canada. As an example suppose you invest 100000 in a Canadian equity ETF and then the value declines to 90000. In Canada 50 of capital gains are.

The analysis demonstrated that benefits from tax-loss harvesting do not take place in an isolated corner of an investors taxable account. Canadian aggregate bonds for. This maneuver is known as tax-loss harvesting or tax loss selling.

Tax-Loss Harvesting Is Complicated.

Watch Tax Loss Harvesting A Silver Lining For Bonds Vanguard Bloomberg

Another Way To Think About Tax Loss Harvesting Tax Asset Creation Russell Investments

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Using Exchange Traded Funds In Tax Loss Planning

How To Use Tax Loss Harvesting To Boost Your Portfolio

![]()

2022 Crypto Tax Loss Harvesting Guide Cointracker

Planning Ahead How To Execute A Tax Loss Selling Strategy

Tax Loss Harvesting Rules How To Tax Loss Harvest White Coat Investor

Crypto Tax Loss Harvesting Investor S Guide Koinly

Crypto Tax Loss Harvesting Investor S Guide Koinly

How Tax Loss Harvesting Offsets Gains Income Youtube

New Tax Time Strategy Tax Loss Harvesting Ticker Tape

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Tax Loss Harvesting Flowchart Bogleheads Org

What Is Tax Loss Harvesting Ticker Tape