arizona residential solar energy tax credit

The credit is allowed against the taxpayers. Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property.

Off Grid Solar Work In Arizona Southface Solar Electric Az

Extension of the Section 48 energy investment tax credit the ITC for solar combined heat and power qualified fuel cell microturbine waste energy small wind biogas.

. As a credit you take the amount directly off your tax payment rather than as. The maximum tax credit that can be claimed for a qualified system in any one year is 2 million. The credit is allowed against the taxpayers.

Arizona offers state solar tax credits -- 25 of the total system cost up to 1000. 23 rows A nonrefundable individual tax credit for an individual who installs a. 41-1511 was established by the Arizona.

So when youre deciding on whether or not to. Ad Produce Renewable Solar Energy for Your Home and Take Control of Your Energy Costs. For 2022 the rate of this credit is 26 percent but its expected to drop to 22 percent in 2023 before going away entirely in 2024.

Ad Determine The Right Solar Panel Company For You. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. The Renewable Energy tax credit ARS.

Best Solar Panel Companies In Your Area. The tax credit for wind and biomass systems equals 001 per kilowatt-hour kWh for the. The Renewable Energy Production Tax Credit is for production of electricity using qualified energy resources that is sold to an unrelated entity or public service.

Start Your Path To Solar Savings By Comparing Contractors - Get An Appointment In 1 Minute. Calculate what system size you need and how quickly it will pay for itself after rebates. Ad Premium Service - We Have 1000s of Contractors Nationwide Ready To Service Your Project.

What is a tax credit. Can a taxpayer take the solar energy credit for solar energy devices installed on residential rental property owned by the taxpayer. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

The Residential Arizona Solar Tax Credit. - For details about this credit please read the program guidelines first Note. Industrial Solar Tax Credit.

Arizona State Energy Tax Credits. Check Rebates Incentives. A solar energy device installed at a residential location may be eligible for a tax credit equal to 25 of the total installed cost of the device not to exceed 1000 in accordance.

The Renewable Energy Tax Incentive Program is not available beginning on or after January 1 2021. This is claimed on Arizona Form 310 Credit for Solar Energy Devices. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

Ad See The Top Rated Solar Companies in Your Area in 2022. Unlike Your Utility Youll Always Know Your Solar Cost with Sunnova. Arizonas Solar Energy Credit provides an individual taxpayer with a credit for installing a solar or wind energy device or system at the taxpayers Arizona residence.

Solar tax credit amounts. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. A tax credit is a dollar-for-dollar reduction in the amount of income tax you would otherwise owe.

The Residential Arizona Tax Credit is. A taxpayer is eligible for the credit only for a. No more than 20 million can be approved by the department in a calendar year.

The average cost of a solar panel system ranges between 15000 and 25000. Ad Find solar companies near you based on recent installations in your zip code. The Solar ITC can help to significantly reduce the total cost of a home solar system.

The percentage you can claim depends. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system. Check Our Easy-To-Read Rankings.

Arizona law provides a solar energy credit for buying and installing a solar energy device at 25 25 of the cost including installation or 1000 whichever is less. Easy to Qualify In Minutes. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system.

Read Our Company Breakdowns. Ad Find solar companies near you based on recent installations in your zip code. 26 rows Property Tax Refund Credit Claim Form -- Fillable.

Get Pricing Calculate Savings. Qualifying properties are solar electric. Installing renewable energy equipment in your home can qualify you for a credit of up to 30 of your total cost.

Calculate what system size you need and how quickly it will pay for itself after rebates. For example claiming a 1000 federal tax credit reduces your federal. 2 days agoThe climate bill a surprise agreement between Senators Joe Manchin and Chuck Schumer would restore a 30 tax credit for residential solar systems making it applicable.

The credit is allowed.

Energy Solar Energy Panels Solar Renewable Sources Of Energy

Solar Farm Rejected Amid Fears It Will Suck Up The Sun S Energy Solar Farm Solar Solar Panels

The Best And Worst States To Get Solar Panels For Your Rooftop Solar Power Solar Energy Facts Solar Power House

Is Solar In Arizona Actually Free

Are Solar Panels Worth It In Arizona Yes Ae Llc

Free Solar Panels Arizona What S The Catch How To Get

Federal Tax Credit For Solar Panels Going Away In 2020 Solar Solution Az

Solar Tax Credit In 2021 Southface Solar Electric Az

Off Grid Solar Kit Northern Arizona Wind Sun Solarpanelkits Solar Panel Installation Solar Panel System Solar Kit

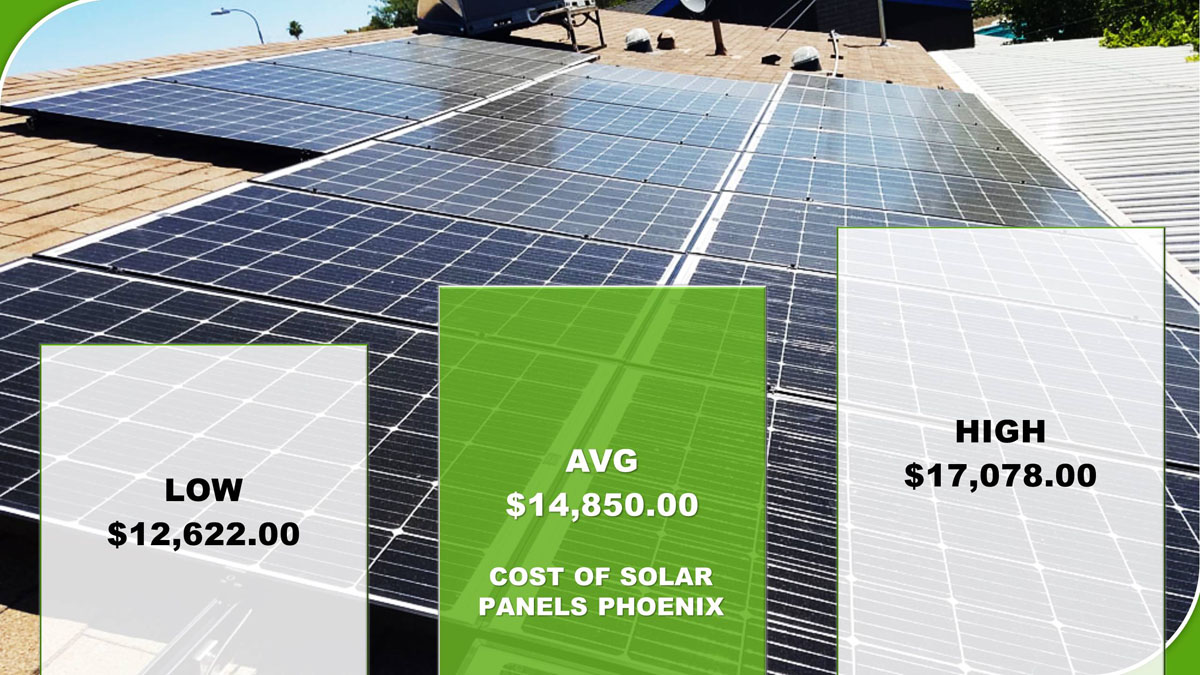

Solar Panels Cost Phoenix 2020 Cost Vs Savings Calculator

Are Solar Panels Worth It In Arizona Yes Ae Llc

Energy Solar Power House Solar Energy Panels Solar Panels

Are Solar Panels Worth It In Arizona Yes Ae Llc

How Much Do Solar Panels Save Alternative Energy Llc

Cost Of Service Arizona S Solar Saga Takes On The Valuation Question Solar Roof Solar Panel Arizona

Do Solar Panels Increase Home Value In Arizona Solar Fix Az

Why Do Arizona Homeowners Go Solar Sunsolar Solutions

The Current Future State Of U S Electricty Prices Solar Cost Solar Projects Solar Power System